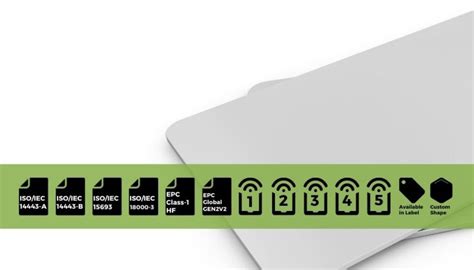

rfid embedded credit cards An RFID chip credit card, also known as a contactless credit card or a tap-and .

Scores, game details, and how to watch.

0 · what is an rfid card

1 · rfid symbol on credit card

2 · rfid credit cards list

3 · rfid credit cards explained

4 · rfid credit card sign

5 · rfid credit card scams

6 · protective shields for credit cards

7 · credit card rfid trackable

View scores and results from week 1 of the 2018 NFL Postseason

RFID credit cards are considered to be as safe as EMV chip cards, and data theft concerning RFID cards is uncommon. This is because of how these cards transmit information and what. To keep your RFID credit cards safe, keep your card in an RFID shield wallet or sleeve to block RFID scanners from reading your personal information. If you don’t have one .RFID credit cards, also known as contactless cards, utilize RFID technology to facilitate .

smart card distribution schedule in jhenaidah

Radio-Frequency Identification (RFID) technology in credit cards enables tap-to . RFID-enabled credit cards - also called contactless credit cards or “tap to pay” .

An RFID chip credit card, also known as a contactless credit card or a tap-and .An RFID credit card, also known as a contactless credit card, is a type of payment card that . Say your bank sent you a credit or debit card with an embedded RFID chip. The .

In a nutshell, an RFID credit card has an electronic tag and antenna embedded . RFID credit cards are embedded with a tag that enables contactless payments, one of the safest ways to pay.

RFID credit cards are considered to be as safe as EMV chip cards, and data theft concerning RFID cards is uncommon. This is because of how these cards transmit information and what. To keep your RFID credit cards safe, keep your card in an RFID shield wallet or sleeve to block RFID scanners from reading your personal information. If you don’t have one of these sleeves, try putting several RFID cards together in your wallet to make it harder for the scanner to isolate an individual card.RFID credit cards, also known as contactless cards, utilize RFID technology to facilitate wireless data exchange between the card and a payment terminal. When you tap or wave your RFID credit card near a contactless-enabled payment terminal, the terminal emits a radio frequency signal that powers the RFID chip embedded in the card. Radio-Frequency Identification (RFID) technology in credit cards enables tap-to-pay transactions by using electromagnetic fields to automatically identify and track tags attached to objects, in this case, the credit card.

RFID-enabled credit cards - also called contactless credit cards or “tap to pay” cards - have tiny RFID chips inside of the card that allow the transmission of information. The RFID chip itself is not powered, but instead relies on the energy transferred by an RF-capable payment terminal. An RFID chip credit card, also known as a contactless credit card or a tap-and-go card, contains a tiny embedded chip that communicates with a payment terminal via radio waves. This eliminates the need to swipe or insert the card into a machine, making transactions faster and more efficient.

An RFID credit card, also known as a contactless credit card, is a type of payment card that uses radio frequency identification (RFID) technology to facilitate quick and convenient transactions.

Say your bank sent you a credit or debit card with an embedded RFID chip. The idea sounds appealing: When you make a purchase, instead of slipping your card into a reader and waiting for a. In a nutshell, an RFID credit card has an electronic tag and antenna embedded that transmits the payment information to a reader. This same technology allows you to wave your gas card at the pump to earn rewards or drive through a tollbooth with your E-ZPass. RFID credit cards are embedded with a tag that enables contactless payments, one of the safest ways to pay.

RFID credit cards are considered to be as safe as EMV chip cards, and data theft concerning RFID cards is uncommon. This is because of how these cards transmit information and what. To keep your RFID credit cards safe, keep your card in an RFID shield wallet or sleeve to block RFID scanners from reading your personal information. If you don’t have one of these sleeves, try putting several RFID cards together in your wallet to make it harder for the scanner to isolate an individual card.RFID credit cards, also known as contactless cards, utilize RFID technology to facilitate wireless data exchange between the card and a payment terminal. When you tap or wave your RFID credit card near a contactless-enabled payment terminal, the terminal emits a radio frequency signal that powers the RFID chip embedded in the card.

Radio-Frequency Identification (RFID) technology in credit cards enables tap-to-pay transactions by using electromagnetic fields to automatically identify and track tags attached to objects, in this case, the credit card. RFID-enabled credit cards - also called contactless credit cards or “tap to pay” cards - have tiny RFID chips inside of the card that allow the transmission of information. The RFID chip itself is not powered, but instead relies on the energy transferred by an RF-capable payment terminal. An RFID chip credit card, also known as a contactless credit card or a tap-and-go card, contains a tiny embedded chip that communicates with a payment terminal via radio waves. This eliminates the need to swipe or insert the card into a machine, making transactions faster and more efficient.

An RFID credit card, also known as a contactless credit card, is a type of payment card that uses radio frequency identification (RFID) technology to facilitate quick and convenient transactions.

Say your bank sent you a credit or debit card with an embedded RFID chip. The idea sounds appealing: When you make a purchase, instead of slipping your card into a reader and waiting for a.

what is an rfid card

$12.69

rfid embedded credit cards|what is an rfid card