contactless payment limit lloyds a credit card According to new data from Lloyds Bank* spend on debit cards made in person, . In this post, I will show you how to read and write an NFC tag on an Android .Many SIM cards provided by wireless carriers also contain a secure element. Android 4.4 and higher provide an additional method of card emulation that doesn't involve a .

0 · lloyds contactless payment limit uk

1 · lloyds contactless payment limit

2 · lloyds contactless not working

3 · lloyds contactless limit uk

4 · lloyds contactless card not working

5 · lloyds bank contactless payment limit

6 · contactless payment limit per day

7 · can you withdraw money contactless

Around the Promoted by Taboola. Get the latest 2024 NFL Playoff Picture seeds and scenarios. See the full NFL conference standings and wild card teams as if the season ended today.

Since this feature was introduced in autumn 2021, 800,000 debit card customers . According to new data from Lloyds Bank* spend on debit cards made in person, .

Contactless card. Make secure payments with your card wherever you see the contactless .Make everyday payments using Google Pay without the contactless card limit. It's safe, simple, . Furniture accounted for 77% of contactless payments, electrical 68% and .

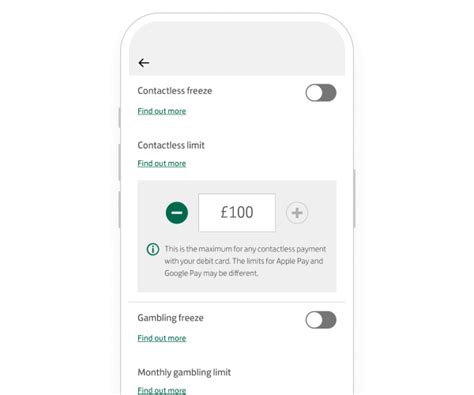

What is the contactless payment limit? The current contactless limit in the UK is . Lloyds Bank, Halifax and Bank of Scotland customers will be able to set their . The contactless payment limit, which is the amount you can spend on card without entering a PIN, will rise from £45 to £100 from 15 October, it's been confirmed. It comes after chancellor Rishi Sunak formally announced the .

You cannot make a contactless payment of over £100 using your card. You will need to insert your card into the card reader and type in your PIN or complete a swipe transaction. Different limits may apply if you are using Apple or Google Pay. Since this feature was introduced in autumn 2021, 800,000 debit card customers have used it to freeze contactless payments, or choose an alternative limit. Over half (60%) of debit card customers who have set their own limit have opted for one under £50. According to new data from Lloyds Bank* spend on debit cards made in person, using contactless technology, has grown from 65% to 87% in the last three years. In April 2020 – during the pandemic - the contactless limit was increased from £30 to .

Contactless card. Make secure payments with your card wherever you see the contactless symbol. Or add your card to your phone, to make paying even quicker. Paper-free statements. Get your statements delivered online instead of through your letter box.

lloyds contactless payment limit uk

Tap-to-pay cards and mobile wallets provide contactless payment options that reduce the amount of contact required and have seen a major increase in popularity in recent years, especially as.Make everyday payments using Google Pay without the contactless card limit. It's safe, simple, and secure. Get benefits such as Everyday Offers on debit card and credit card purchases. Furniture accounted for 77% of contactless payments, electrical 68% and average retail came in at 87%. Lloyds was the first bank to allow customers to choose their own contactless limit for spending – between £30 and £95 – on a debit or credit card. What is the contactless payment limit? The current contactless limit in the UK is £100. Initially, you could typically only authorise contactless payments of £30 and under. The limit was then increased to £45 at the start of the coronavirus pandemic.

Lloyds Bank, Halifax and Bank of Scotland customers will be able to set their own contactless card limits from next month when the higher £100 cap comes into force. From 15 October, the contactless card limit will rise from £45 to £100. The contactless payment limit, which is the amount you can spend on card without entering a PIN, will rise from £45 to £100 from 15 October, it's been confirmed. It comes after chancellor Rishi Sunak formally announced the plans in the spring Budget.

You cannot make a contactless payment of over £100 using your card. You will need to insert your card into the card reader and type in your PIN or complete a swipe transaction. Different limits may apply if you are using Apple or Google Pay.

Since this feature was introduced in autumn 2021, 800,000 debit card customers have used it to freeze contactless payments, or choose an alternative limit. Over half (60%) of debit card customers who have set their own limit have opted for one under £50. According to new data from Lloyds Bank* spend on debit cards made in person, using contactless technology, has grown from 65% to 87% in the last three years. In April 2020 – during the pandemic - the contactless limit was increased from £30 to .Contactless card. Make secure payments with your card wherever you see the contactless symbol. Or add your card to your phone, to make paying even quicker. Paper-free statements. Get your statements delivered online instead of through your letter box. Tap-to-pay cards and mobile wallets provide contactless payment options that reduce the amount of contact required and have seen a major increase in popularity in recent years, especially as.

Make everyday payments using Google Pay without the contactless card limit. It's safe, simple, and secure. Get benefits such as Everyday Offers on debit card and credit card purchases. Furniture accounted for 77% of contactless payments, electrical 68% and average retail came in at 87%. Lloyds was the first bank to allow customers to choose their own contactless limit for spending – between £30 and £95 – on a debit or credit card. What is the contactless payment limit? The current contactless limit in the UK is £100. Initially, you could typically only authorise contactless payments of £30 and under. The limit was then increased to £45 at the start of the coronavirus pandemic. Lloyds Bank, Halifax and Bank of Scotland customers will be able to set their own contactless card limits from next month when the higher £100 cap comes into force. From 15 October, the contactless card limit will rise from £45 to £100.

lloyds contactless payment limit

The Hunter Cat NFC is the latest security tool for contactless (Near Field Communication) used in access control, identification and bank cards. Specially created to identify NFC readers and sniffing tools, with this tool you can audit, .

contactless payment limit lloyds a credit card|lloyds contactless payment limit uk