is running a business off a debit card smart It’s possible to encourage card payments in your business without altogether eliminating cash. You can incentivize card payments with rewards or even simply use signs that say “card encouraged.”

Some of the bestselling zelda nfc cards available on Etsy are: NOW SHIPPING 4 New .NFC, which is short for near-field communication, is a technology that allows devices like phones and smartwatches to exchange small bits of data with other devices and read NFC-equipped cards over relatively short distances. The technology behind NFC is very similar to radio-frequency identification . See more

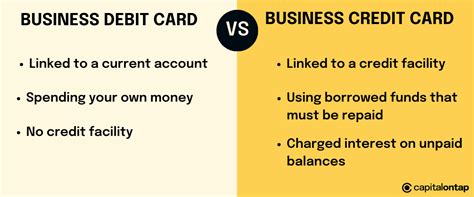

0 · business debit card vs business credit card

1 · business debit card scam

2 · business debit card pros and cons

3 · business debit card fraud protection

4 · business debit card denied

5 · business debit card credit card

Step 2: Check your tap to pay setup. Open the Google Wallet app . At the top right, tap your .

The relationship between card payments in small businesses has always been precarious. Many of us have likely accidentally tried to pay at a small local business, only to discover it doesn’t accept cards. Or if it does, there’s a minimum purchase amount enforced. This is because of the interchange fees . See moreFor the business owner, there are plenty of reasons to eliminate cash in-store. For the most part, it’s just more convenient for the cardholder and clerk. . See moreFor some small businesses, the benefits they’ll see just isn’t worth losing out on potential customers or paying extra fees. There are a few other problems to consider. Excludes potential customers Cashless stores can create a backlash, because it can . See moreThere are other things you should take into account before eliminating cash. For one, not every city allows a cashless business. Philadelphia was one of the first to ban them, and it’s . See more

These are some pros and cons of using a business debit card versus a credit card when starting a small business. It’s possible to encourage card payments in your business without altogether eliminating cash. You can incentivize card payments with rewards or even simply use signs that say “card encouraged.”

These are some pros and cons of using a business debit card versus a credit card when starting a small business.Ultimately, deciding between a business debit card and a business credit card comes down to how you handle money. If you know you’ll pay it off every month, a credit card has a lot of perks. If . Learn about the differences between business debit cards and business credit cards, and empower your business with informed decision-making. With a business debit card, you can turn off overdraft protection and get denied when you don’t have funds available on your account. Credit cards, on the other hand, allow you to borrow.

What Are the Pros of a Business Debit Card? 1. It’s Convenient. Since most merchants accept debit cards, you typically don’t have to worry about having a backup payment method. It's very simple to use a business debit card; all you'll need to do is swipe your physical card and enter your personal identification number (PIN).

business debit card vs business credit card

A company debit card is exactly what it sounds like . . . a debit card for business purposes only. It’s a bank card connected to your business’s bank account. And just like your personal debit card, you can only spend what you have in the account—to the penny.While every business owner’s financial situation is slightly different, in general, it could make sense to use a business debit card for these purchases or costs: Utility bills and cell phone bills. Rent payments. Everyday purchases like supplies. Assets you want to pay off immediately. Should you use credit cards or debit cards for business expenses? When deciding whether to use credit or debit cards for your company’s expenses, keep these three factors in mind: your financial management strategy, the nature of the expenses, and the specific needs of .A business debit card is used to make purchases from existing funds while a business credit card draws from a line of credit. Each has its own advantages and drawbacks that you need to be aware of in order to determine which is right for your business.

It’s possible to encourage card payments in your business without altogether eliminating cash. You can incentivize card payments with rewards or even simply use signs that say “card encouraged.”

These are some pros and cons of using a business debit card versus a credit card when starting a small business.

Ultimately, deciding between a business debit card and a business credit card comes down to how you handle money. If you know you’ll pay it off every month, a credit card has a lot of perks. If .

business debit card scam

business debit card pros and cons

business debit card fraud protection

Learn about the differences between business debit cards and business credit cards, and empower your business with informed decision-making. With a business debit card, you can turn off overdraft protection and get denied when you don’t have funds available on your account. Credit cards, on the other hand, allow you to borrow.

What Are the Pros of a Business Debit Card? 1. It’s Convenient. Since most merchants accept debit cards, you typically don’t have to worry about having a backup payment method. It's very simple to use a business debit card; all you'll need to do is swipe your physical card and enter your personal identification number (PIN).

A company debit card is exactly what it sounds like . . . a debit card for business purposes only. It’s a bank card connected to your business’s bank account. And just like your personal debit card, you can only spend what you have in the account—to the penny.

While every business owner’s financial situation is slightly different, in general, it could make sense to use a business debit card for these purchases or costs: Utility bills and cell phone bills. Rent payments. Everyday purchases like supplies. Assets you want to pay off immediately. Should you use credit cards or debit cards for business expenses? When deciding whether to use credit or debit cards for your company’s expenses, keep these three factors in mind: your financial management strategy, the nature of the expenses, and the specific needs of .

disadvantages of smart card reader

deus ex hr smart card

Key Takeaways. NFC stands for "Near Field Communication," and it enables devices to communicate wirelessly over a short distance. NFC is most commonly used for mobile payments, such as Google Pay and Apple Pay. .Contactless cards work a lot like mobile wallets. The transaction is completed by holding or tapping the card on a contactless-enabled card reader. The technology is also known as “tap to pay” or “tap and go.”. It’s up to 10 times faster than swiping, inserting or using cash. .

is running a business off a debit card smart|business debit card scam