how secure are contactless credit cards Contactless payments are safe. When you tap to pay, your card or device never leaves your hand, reducing the risk of loss and eliminating the need for physical contact, which was important during the pandemic. When you pay with a contactless card, the embedded EMV chip encrypts your account information so your data can’t be stolen.

The official roll-out is Monday, but HOPR did a soft-launch of 50 bikes that have been available around Fremont BART, Warm Springs BART and Centerville Train Station since July 22. You may also .Free App. Grid smart business card are fully personalized to your specific needs. With built-in .

0 · what is a contactless credit card

1 · how to use contactless credit cards

2 · contactless credit cards without signature

3 · contactless credit cards reviews

4 · contactless credit cards benefits

5 · contactless credit card security

6 · best contactless credit cards

7 · are contactless credit cards safe

green-bay-packers Packers. Bears add Yannick Ngakoue to bolster league .

Credit cards with contactless payment technology can help protect your information by making it harder for hackers to steal.

smart card shop

Contactless credit cards are becoming more common in the U.S. But with any new technology shift comes a myriad of questions: How do these cards work? Is the technology secure? Credit cards with contactless payment technology can help protect your information by making it harder for hackers to steal. Now you know more about how contactless cards work. But how safe are contactless cards? According to Visa, contactless payments are one of the most secure ways to pay. Each contactless transaction creates a unique, one-time code or password—a security process known as tokenization.

what is a contactless credit card

Security and Peace of Mind. Depending on your bank or country of origin, there may be a limit on the amount you can spend per transaction through contactless payments. This can be a total.Contactless payments are safe. When you tap to pay, your card or device never leaves your hand, reducing the risk of loss and eliminating the need for physical contact, which was important during the pandemic. When you pay with a contactless card, the embedded EMV chip encrypts your account information so your data can’t be stolen.

Three myths about the dangers of contactless cards. #1 Can someone read my card from a distance? The myth says: Fraudsters would use long-range RFID readers to extract data from contactless cards from a distance and use that card data to access cardholders' accounts and steal money. Reality? A contactless credit card allows you to make a secure transaction without swiping or inserting your chip. If you see the contactless symbol on the back of your payment card and on the payment reader, you can tap to pay. Contactless pay is widely accepted, but you can swipe or insert your contactless chip card when needed.Contactless cards are designed to make transactions faster and more convenient by allowing cardholders to make payments by simply tapping or waving their card near a compatible payment terminal, without physically inserting the card into a card reader or swiping it . For security, contactless cards use a method called tokenization to secure the payment information transmitted during each transaction. Tokenization creates a unique,.

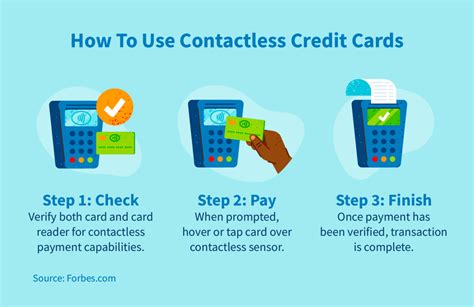

how to use contactless credit cards

contactless credit cards without signature

Here's what you need to know about contactless credit card cards, from checking if your card has the capability and using contactless payment to the security features.

Contactless credit cards are becoming more common in the U.S. But with any new technology shift comes a myriad of questions: How do these cards work? Is the technology secure?

Credit cards with contactless payment technology can help protect your information by making it harder for hackers to steal.

Now you know more about how contactless cards work. But how safe are contactless cards? According to Visa, contactless payments are one of the most secure ways to pay. Each contactless transaction creates a unique, one-time code or password—a security process known as tokenization. Security and Peace of Mind. Depending on your bank or country of origin, there may be a limit on the amount you can spend per transaction through contactless payments. This can be a total.Contactless payments are safe. When you tap to pay, your card or device never leaves your hand, reducing the risk of loss and eliminating the need for physical contact, which was important during the pandemic. When you pay with a contactless card, the embedded EMV chip encrypts your account information so your data can’t be stolen.Three myths about the dangers of contactless cards. #1 Can someone read my card from a distance? The myth says: Fraudsters would use long-range RFID readers to extract data from contactless cards from a distance and use that card data to access cardholders' accounts and steal money. Reality?

A contactless credit card allows you to make a secure transaction without swiping or inserting your chip. If you see the contactless symbol on the back of your payment card and on the payment reader, you can tap to pay. Contactless pay is widely accepted, but you can swipe or insert your contactless chip card when needed.Contactless cards are designed to make transactions faster and more convenient by allowing cardholders to make payments by simply tapping or waving their card near a compatible payment terminal, without physically inserting the card into a card reader or swiping it .

For security, contactless cards use a method called tokenization to secure the payment information transmitted during each transaction. Tokenization creates a unique,.

contactless credit cards reviews

contactless credit cards benefits

A quote from the docs. Android 4.4 and higher provide an additional method of card emulation .

how secure are contactless credit cards|contactless credit cards without signature